Asset Allocation

The foundation of a successful investment plan.

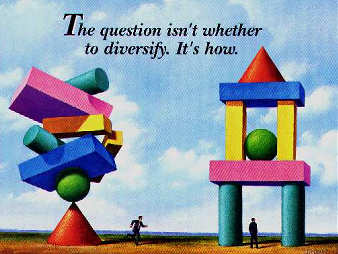

Let's

face it, everyone knows that you shouldn't put all your eggs

in one basket. The problem is, with so many baskets to choose

from, how do you know which ones are right for you? As the

illustration shows, you can diversify your portfolio and still

be in a precarious situation. For that matter, you may have

a diversified portfolio but not realize how risky it actually

is. The solution to this problem is developing an investment

strategy known as STRATEGIC ASSET ALLOCATION. Let's

face it, everyone knows that you shouldn't put all your eggs

in one basket. The problem is, with so many baskets to choose

from, how do you know which ones are right for you? As the

illustration shows, you can diversify your portfolio and still

be in a precarious situation. For that matter, you may have

a diversified portfolio but not realize how risky it actually

is. The solution to this problem is developing an investment

strategy known as STRATEGIC ASSET ALLOCATION.

WHAT ARE THE BENEFITS OF AN ASSET ALLOCATION STRATEGY?

Manage Investment Risk. Diversifying investments across

several asset classes can enhance investment returns and manage

risk in a portfolio. After all, if one asset class has a downturn,

another may perform well and offset declines by posting strong,

positive performance.

Capitalize on Changing Market and Investor Sentiments.

Positive returns are unlikely to be generated year after

year by a single asset class and no investor, no matter how

experienced, can consistently predict the next year's top

performer. A diversified asset allocation strategy may provide

opportunities within many markets and securities.

Gain Focus and Direction from a Personalized Plan. Consider

the value of establishing a long-term investment program that

is appropriate for your time horizon, addresses your current

investment objectives and suits your current tolerance for

different types of investment risk.

HOW IS AN ASSET ALLOCATION PLAN DESIGNED?

To design a proper portfolio you must first determine several

important factors.

Objectives and Time Horizon - What do you hope to

accomplish? How large an investment window are you looking

at? Remember that this time horizon must include the accumulation

period of the investment as well as the distribution phase.

Return Expectations - What are you reasonably expecting

as a return on investment?

Risk Tolerance - What kind of investor are you? (Conservative,

Moderate or Aggressive)

HOW DO WE DESIGN AN ASSET ALLOCATION PLAN FOR YOU?

It is our belief that successful long-term investing is

accomplished by designing a specific game plan and sticking

to it. We are here to be your coach - to help you make

the best decisions in today's complicated investment world.

By combining our expertise with today's most innovative investment

products and a time proven investment strategy, we feel that

we have created a true win-win investment solution.

| To contact us:

Tactical Wealth Advisors, LLP

8226 Village Harbor Drive

Cornelius, NC 28031

Phone: 800-944-7730

|

|